Prime Minister Loan Scheme

PM Youth Loan Scheme: Dear Youngsters! Remember one thing, you are the future of Pakistan. The Almighty has blessed you with many skills and qualities. Use your Skills in Good ways and become the reason for the development of Pakistan. You are the builder of the nation. For the development of the country and its people Prime Minister of Pakistan introduced the PM Youth Loan Scheme program for the bright future of Pakistani youth.

The youth program was started in 2013-2018 by the Pakistani Government. This Program has many schemes. The Prime Minister of Pakistan initiated an agriculture loan scheme, a business loan scheme for the youth to develop their future. The Prime Minister’s Scheme for the Provision of Laptops, and the Prime Minister’s Scheme for the Reimbursement of Fees of Students from the Less Developed Areas.

Click Here For More Info: BISP Stipend Increase in August 2025 – Complete information for Deserving Individuals.

Prime Minister’s Youth Business & Agriculture Loan Scheme 15 Commercial Islamic and SMI Banks promote entrepreneurship among young people by providing business loans on easy terms and with low markups. Pakistani people aged between 21 to 45 are eligible to apply for business schemes. The age limit for IT/E e-commerce-related business is 18 years. This loan is divided into three levels.

- Tier 1

- The range is 0.5 million PKR with 0% markup.

- Tier 2

- The range is above 0.5 million up to 1.5 million PKR with a 5% markup.

- Tier 3

- The range is above 1.5 million up to 7.5 million PKR with a 7% markup.

Application form for Youth Loan Program

You can apply for the Prime Minister Youth loan program in 2024. Here, we will give all the details about applying for a loan simply. Please fill out this form to apply for the Youth Loan Program 2024.

Also Read: Punjab Khidmat Card Program

Youth Loan Application Form

You can apply for the Youth loan program in 2024. Here, we will give all the details about applying for a loan simply. Please fill out this form to apply for the Youth Loan Program 2024.

Youth Loan Procedure

- Documents required:

- Passport-size picture CNIC (front and back)

- Latest Educational degree/certificate (if applicable)

- Experience certificate(s) (if applicable)

- Registration with Chamber or Trade Body (if applicable)

- Recommendation Letter from the respective chamber/trade body or Union (if applicable)

- Information required: National Tax Number, Consumer ID of electricity bill of your current addres,andds Consumer ID of electricity bill of your current office address (if applicable)

- Complete the registration number of any vehicle registered in your name (if applicable). Name, CNIC, and mobile numbers of two references other than blood relatives. Estimate of monthly business income, business expenses, household expenses, and other income (for new business).

Youth Loan Other Requirements

- Sign up to submit an application

- Mobile number registered in your name

- At least 15 minutes to complete the application form

- Option to save a draft for submission later

- Upload as much information as you have (e.g., Financial Statements, Business Feasibility, Last 6 months’ Bank statements)

- The application registration number will appear on the screen, and you will receive an SMS once the form is submitted.

- Message once your application moves to the next stage of the process

- Check the application status on the official website.

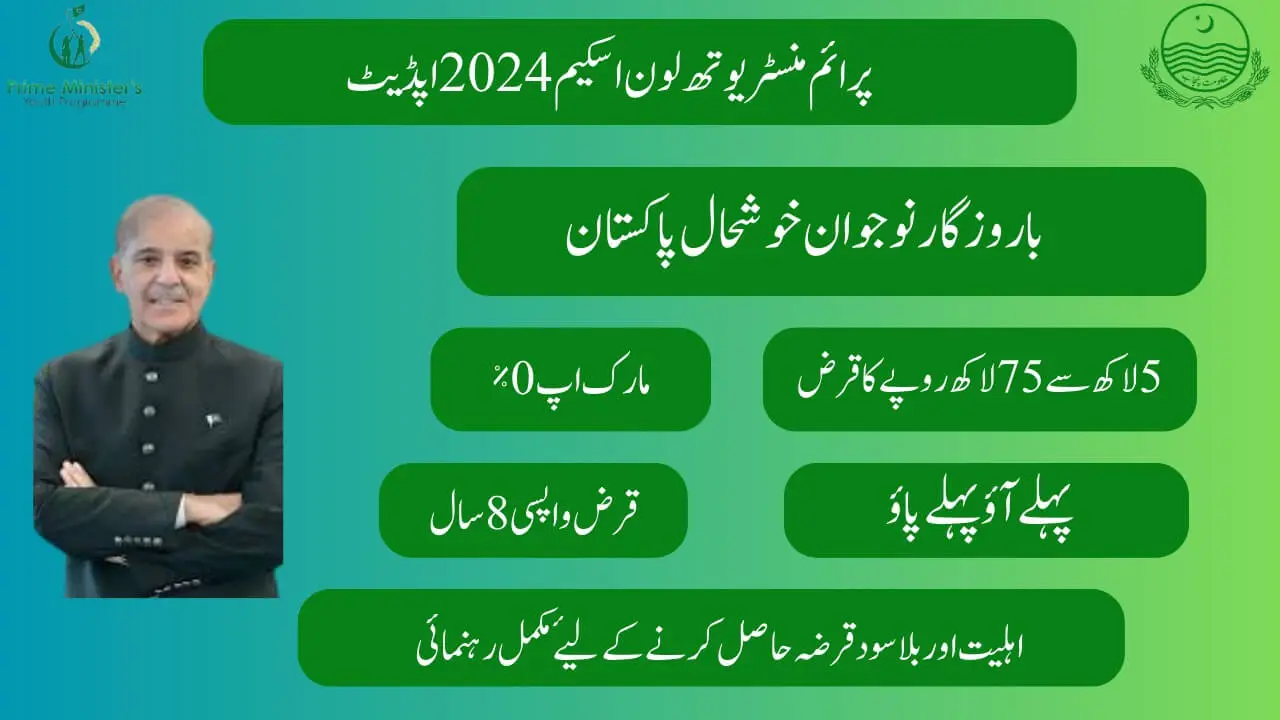

2024 Update for PM Youth Loan Scheme

This program was started in 2019 and will continue in 2021. Pakistani youth apply for this loan for their education expenses and other things. The loan was free of interest. And youth can pay this in smart installments. Many people in 2021 applied for this loan and took advantage of it. This was a good act by the government during the COVID-19 pandemic.

Types of PM Youth Loan Scheme

The Prime Minister’s Youth Business and Agriculture Loan Scheme provides two types of loans to the youth ,which are classified as:

- Long-Term / Development Loans

- Working Capital/Production Loans

Loan Quantity for PM Youth Loan Scheme

You can apply for this loan of 8 million under the Prime Minister Youth loan scheme. If he does not understand how to apply. Visit the Prime Minister’s website, get all the information from the website, and click the button for registration.

Eligibility Criteria for Youth Loan Program

Loan program (PMYB&ALS)

- Any Pakistani, including (AJK & B nationals, having g CNIC or Form B, with Age 18-45

National Innovation Award

- Any Pakistani, including (AJK & GB) National, having Ca NIC or Form B and aged 15-35

Talent Hunt Youth Sports League (THYSL)

- Any Pakistani, including (AJK & GB) National having CNIC or Form B with Age: 15-25

Also Read: How To Check BISP Payment 13500 2025 – Step-by-Step Guide

قرض کی درخواست دینے کا طریقہ کار

اس پروگرام کے ذریعے قرضہ لینے کا عمل بالکل سادہ اور آسان ہے آپ کو درج ذیل اقدامات پر عمل کرنا ہے اور آپ آسانی سے قرض حاصل کر سکیں گے

سب سے پہلے آپ کو دیے گئے ایپلیکیشن فارم کے بٹن کو کلک کرنا ہے

اس کے بعد آپ کو وہاں پر ایک فارم دیا جائے گا اس فارم میں اپنے تمام تر معلومات درج کرنی ہے

اس کے بعد آپ کے تمام تر معلومات گورنمنٹ آف پاکستان کے پاس چلی جائیں گی اگر آپ قرض کے لئے اہل ہوئے تو آپ کو بتا دیا جائے گا

اور اگر آپ کو یہ جاننا چاہتے ہیں کہ ابھی تک آپ کی درخواست پر عمل ہوا ہے یا نہیں ہوا تو آپ ایپلیکیشن سٹیٹس کے بٹن پر کلک کر کے اپنی درخواست کے بارے میں جان سکتے ہیں

اس کے علاوہ اگر آپ یہ جاننا چاہتے ہیں کہ آپ کو ہر ماہ کتنی قسط ادا کرنی ہوگی اور آپ کتنے سالوں میں یہ قرضا اتارنا چاہتے ہیں

Conclusion

This article has been written for those who want to get a loan from the Ehsaas program and want to start their own business. This is a good option for middle-class families. I hope that after reading this, you have no problem or confusion. If you have any problem with getting a loan, you can contact customer support and get a Solution for your problem.

PM Youth Loan Payment Terms

Prime Minister Youth Living Online Apply offers borrowers flexible repayment terms. The loan tenure can range from three to eight years, depending on the loan amount and the nature of the business.

The loan requires or monthly installment, and the interest rate is fixed throughout the repayment period. If you follow these steps, you will get the loan. If you do any of these steps, you won’t get a loan at all.

PM Loan Collection Center

- First of all, you should go to your nearest bank along with your identity card.

- Take a printout of the application there

- After completing the formalities

- Your loan will be transferred to your account as soon as you want

Also Read: How To Check BISP Payment 13500 2025 – Step-by-Step Guide

1 thought on “PM Youth Loan Scheme Online Registration New update 2024”